January 28, 2025

mwoolley_specialevents@tbba.net

With demand on the decline and supply on the rise, indications point to Tampa Bay emerging as a buyers’ market in 2025.

A new Zillow study became the latest in a series of reports forecasting that local buyers will have more negotiating power in the next 12 months. The real estate platform dropped Tampa from No. 10 to No. 29 in its annual ranking of the nation’s hottest markets. Orlando (from No. 9 to No. 23) and Jacksonville (from No. 31 to No. 40) also dropped in the rankings.

Zillow senior economist Orphe Divounguy told WUSF Radio that local home value growth, speed of sales, homeownership rates and job growth composed some of the factors used to determine the index.

“Tampa’s housing market is shifting as the rapid price growth seen in previous years has moderated,” Divounguy told WUSF. “In December 2024, the typical home value was 2.5% lower than a year ago.”

Demand certainly factors into the assessment. A new Tampa Bay Builders Association forecast produced by John Burns Research & Consulting Report noted that listings in Tampa Bay are rising, and resale sales are down 8 percent year over year from December 2023 to December 2024.

That mirrors a trend around the state (except for Miami). Realtor.com said the typical home spent 70 days on the market in December, nine days longer than December 2023.

Experts cite the impact of Hurricanes Helaine and Milton for putting a dent in demand, as well as the overall rise and uncertainty revolving around homeowners’ insurance.

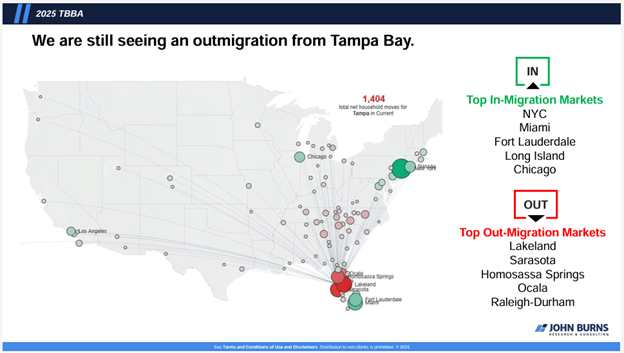

Tampa Bay also is experiencing outmigration, a dynamic shift from the months immediately following the pandemic. The total net household move for Tampa is minus1,404, as evidenced by the graphic below.

The outmigration is also a trend across the state. A Vintage population estimate released by the U.S. Census Bureau estimated that the migration of people moving to Florida from other American states has fallen sharply from 317,923 in 2022 to just 63,346 in December 2024.

The reduced demand aligns with the increase in supply when it comes to home resales. However, Tampa Bay and Florida also have led in new home construction, adding to the supply. Increased stock will increase affordability, an issue in Tampa Bay and across the state, but it could mean a decline in profits for homebuilders, especially if they must add incentives to increase sales.

It won’t help that the 30-year fixed mortgage rate remains just below 7 percent, meaning those who locked in lower mortgage rates immediately after the pandemic are likely to stay put instead of upscaling to a new home – even if prices drop.

Still, the John Burns report projects a moderate 0.6 percent increase in new home prices and a 0.4 percent increase in median resale price for Tampa Bay.

Another positive byproduct of existing homeowners staying put: residential remodeling. The National Association of Home Builders forecast remodeling will continue to trend up through at least 2026 because residents can use equity to make improvements instead of moving. The NAHB’s Remodeling Market Index saw a rise for the fourth quarter of 2024.

In Tampa Bay, the need for disaster resiliency improvements in the wake of the hurricanes should significantly boost remodeling demands.

Another positive factor: the rent to build segment continues to enjoy growth in the region. The John Burns report indicated that there are 4,200 rent to build units under construction, planned or in the conceptual phase.