January 28, 2025

mwoolley_specialevents@tbba.net

President Donald Trump set an immediate tone in his first day in office with an executive order aimed at reducing housing costs.

“What more could you ask for in the first 24 hours of the administration?” said NAHB Chief Executive Officer Jim Tobin on a recent association podcast.

Trump’s emergency order directed the heads of all executive departments and agencies that fall under the executive branch, including the departments of Commerce, Health and Human Services, Labor, and Energy, to "deliver emergency price relief. He emphasized these changes would include lowering the cost of housing and expanding supply.

The housing supply remains one of the driving factors when it comes to affordability. Realtor.com chief economist Danielle Hale told FOX Business that the U.S. is facing a deficit between 2.5 million and 7.2 million homes, which underscores the dire need to build more housing. She said regulatory requirements, which can add significant costs to building and have been a barrier to ramping up supply, are a good place to start.

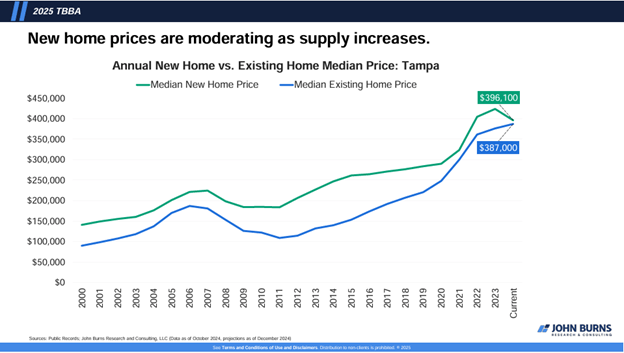

A recent Tampa Bay Builders Association forecast conducted by John Burns Research & Consulting indicates that supply in the market has increased, moderating new home prices.

Research from ResiClub, a media and research company, determined that Florida is one of nine states to have inventory increase to pre-pandemic levels. Resi-Club cited a decrease in work-from-home migration to Florida, new condominium regulations in the wake of the Surfside condo collapse and property insurance costs as factors in reviving the supply.

“Generally speaking,” ResiClub’s Lance Lambert wrote, “local housing markets where active inventory has returned to pre-pandemic levels have experienced softer home price growth (or outright price declines) over the past three years.”

So, if Trump’s reduction in regulations can increase housing supply, it should reduce home price growth and increase affordability.

Still, experts have openly noted that there’s only so much Trump can truly do from the federal level to increase housing affordability. For example, he can’t order the Federal Reserve to further reduce interest rates, and John Burns predicts the 30-year fixed mortgage rate will stay between 6 and 7 percent.

According to Market Watch, a perception that Trump may be softer than expected on tariffs dropped the average 30-year mortgage rate down to 6.96 percent on Jan. 23, the first decline in six weeks, according to data released by Freddie Mac on Thursday.

That was down eight basis points from the previous week — one basis point is equal to one-hundredth of a percentage point. A year ago, the 30-year was lower, averaging at 6.69%.

Home buyers in search of a house they can afford still face an uphill battle. Mortgage rates remain relatively elevated, especially compared with where they were the last time Trump took office.

Darryl Fairweather, the chief economist for Redfin, told FOX Business that the federal government’s limited authority likely means Trump would have to incentivize local governments or take unprecedented federal actions.

"Trump’s plan to cut regulatory red tape focuses on construction costs, but most housing regulations, like zoning laws and permitting, are controlled by local governments,” Fairweather said.

Tobin echoed the point about reducing regulations but added that Trump has some other options.

“I think the bully pulpit, just talking about more home construction, just getting the message out there (can help),” Tobin said.